The economy is doing great.

For the people who manage and control the economy.

Rent go up, people make money!

Median income or ihdi are much better indicators of people’s well-being.

https://en.m.wikipedia.org/wiki/List_of_countries_by_inequality-adjusted_Human_Development_Index

The economy/gdp is just a measure of how much stuff you are making, not who is getting it.

Reminder, economies are meant to be lowly tools of a society to maximize the equitable and efficient distribution of goods and services within said society.

Our western, rigged, market capitalism has metastasized to the point that our society lives in subsistence and subservience to that lowly, broken tool. To the point that when disaster strikes, our societal leaders rush out to reassure us that every possible measure will be taken to protect our

society people childreneconomy.Its perverse to watch, it’s insane, it’s ass backwards, but here we are.

If the people who needed to hear any of that the most could understand a word of it, they would probably be nodding along in agreement and ready to do their part to make changes.

Or they would just call you an “elitist commie” and go take out another payday loan.

I’m well past hope in our lifetimes if I’m honest. I just go on my little frustrated scribes and vent my perspective to hold onto my sanity in an increasingly, from my doomer perspective, self-destructing world.

How do I get rid of this impending doom feel

Drugs

TL;DV

Great for them doesn’t mean great for you.

I haven’t seen it in a while, but I remember Lemmings saying to switch “economy” with “rich people’s yacht money” in your head when reading financial or economic news.

Even then it’s questionable when they’re begging so hard for an interest rate cut.

They’d do that if you literally distributed all the money in the world to the 1% and killed the poor. The least rich would become the new poor and the most rich would be begging for rights to take their yachts, rape their dogs, and empty their bank accounts along with that interest rate cut.

But on npr this morning they said wage growth has outpaced inflation

Over how much time?

I found a recent article by them that said it was outpacing inflation for a month in the sense that wages were growing in real value, which is an incredibly weak standard.

Practically speaking they should be doubled or more to come close to affordability for many Americans.

Long before wages create affordability, they have to out pace inflation. It’s going to take a long period of wages slightly beating inflation for the public to be happy.

Or we could have another recession to make prices drop, but wages would lose ground to inflation when it returns.

Really the last three are the only issues, amd there are ways to specifically address them,

-

Wage gap, for every twentieth multiple of the median of household incomes in the bottom quintile of all incomes, put a percent increase on the nominal tax rate for income above that 20th multiple, and just keep doing that for every 20th after that, also, start counting loans collateralized on capital assets (sans primary home mortgages, primary vehicle car loans and other socially advanceable loans) as salary income for tax purposes, either in all cases or specifically for loans with interest rates significantly lower than the market sustainable rates for loans for everyone else. That or just ban loans with interest rates below the rate of inflation as “failing fiduciary responsibility by literally throwing money away.”

-

Cost of Living, the nordics have a good model here, not price caps, but caps on how much you’re allowed to raise the price annually. I’d say tie it to the federal interest rate, because it’ll be a solid limit on price jacking, and it’ll also put a pretty intense counterbalance of class interests against the typical instinct to keep rates low forever because house price go up.

If anything, the fact that these problems can be tackled so simply almost makes them more infuriating, it’s taking the active effort of knowingly malicious actors to keep these affronts to our rights to a respectable standard of living in place.

The thieves need you to believe they can’t be caught. Their plan falls apart immediately if we act with a plan and agreed on goals.

Unity of action and purpose is the vaccine against corruption.

-

Homeowners reading this like “okay this is not the meme for me”

I’m a homeowner and can say this meme is extremely accurate. Up zone cities!

Yeah, well, someone’s gotta pay for all that free stuff people keep voting for. Guess who that is?

free stuff people keep voting for

Don’t leave us hanging. Where is all this free stuff?

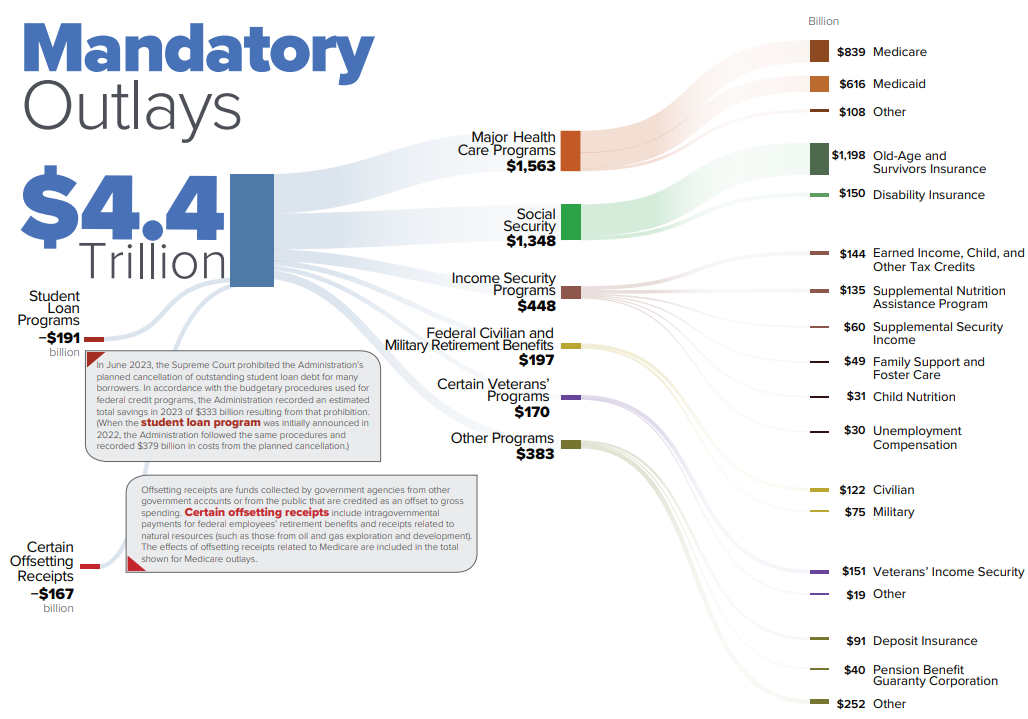

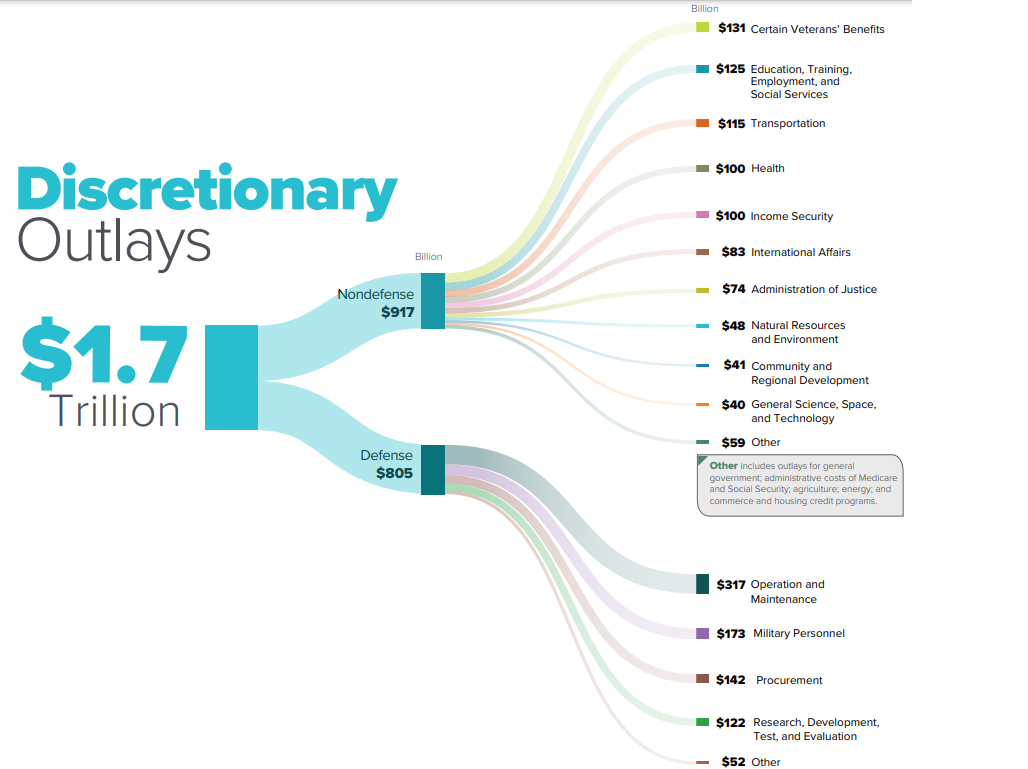

Who said the free stuff is for you? You get roads, public schools, parks, and libraries. As for the rest, see for yourself:

You get roads, public schools, parks, and libraries.

But I pay for all of that with property, gas, and sales taxes. None of it is free.

It’s free for the people who don’t pay taxes.

Who doesn’t pay sales taxes? Who doesn’t eat property taxes, either directly or indirectly? Who doesn’t eat gas taxes?

Children

“Free” is when your parents foot the bill.

Unfortunately no “SWAG” type stuff. If you’re in the US, the majority is spent on entitlements, servicing debt, and the defense budget. In that order.

entitlements, servicing debt, and the defense budget

Definitely depends on how you count.

Discretionary Defense spending totals over $800B in 2023, but doesn’t include a number of additional costs. Total outlays go to over $1T when you add up what Congress authorized plus what Biden requested for weapons R&D, international aid (notably to Ukraine and Israel as well as Pacific Rim territories), and upgrades to our nuclear arsenal by way of the Department of Energy.

That puts the defense budget above Medicare, but below Social Security. It also dwarfs the $650B we’re spending on outstanding interest (remarkably low considering the gross debt). But we’ve seen people stop talking about SS and Medicare as distinct entities, instead mashing them together to make the total look bigger. I’ve also seen folks carving the Tricare/VA costs off the overall Pentagon budget and start talking about it like another entitlement. So… shrug

maybe the billionaires?

Hahahaha no. It’s you. And your children. And your children’s children.

Ok I make minimum wage and pay around 20% to income tax. Explain to me how nothing should change and we should keep funding war

We live in a democracy. And war is what the people want. Apparently, because they keep voting for it.

It’s rhe trillions of dollars in debt bit I’m skeptical that it really matters.

Heyo, national economies need to run at a deficit. The amount of debt needs to be maintained but running a negative is a good thing because the interest payments become stable capital injection. These regular, anticipated payments build the confidence of very conservative money managers to spend their own money. It’s trickle down but in a way that helps increase the likelihood of money being spent, which is basically the GDP. And the speed of people spending money in the system is a metric that central banks use to set interest rates.

It’s all connected and that’s why running a deficit, a (relatively) small one, is a good thing. Nations don’t use checkbook accounting.

At this point, I just use someone complaining about the national debt as a secret code for them saying “I have zero idea how economics works”.

how much of this still applies when the debt is as big as the United State’s current debt? (genuine question)

It applies more. If you borrow $1000 and by the time you pay it back (including interest) you’ve paid $1500, but that would have had the buying power of $2000 today, you’ve made a pretty good deal. If you do that with a trillion dollars, you’ve made a great deal.

National Debt is a weird metric. For the US, the biggest foreign owners are Japan having ~4% and China having ~5% of the debt. The huge majority of the debt is within the US, either to individuals, businesses, or the government itself.

Plus there’s an old adage by J Paul Getty, “If you own the bank $100, that’s your problem. If you owe the bank $100 million, that’s the banks problem.”

Similarly everyone you owe money to is now invested in your success.

I never said we should have zero debt, that’s a strawman. Most economist recommend a moderate amount of debt due to various positive effects (some of which you mention). So the real disagreement comes here:

It’s all connected and that’s why running a deficit, a (relatively) small one, is a good thing.

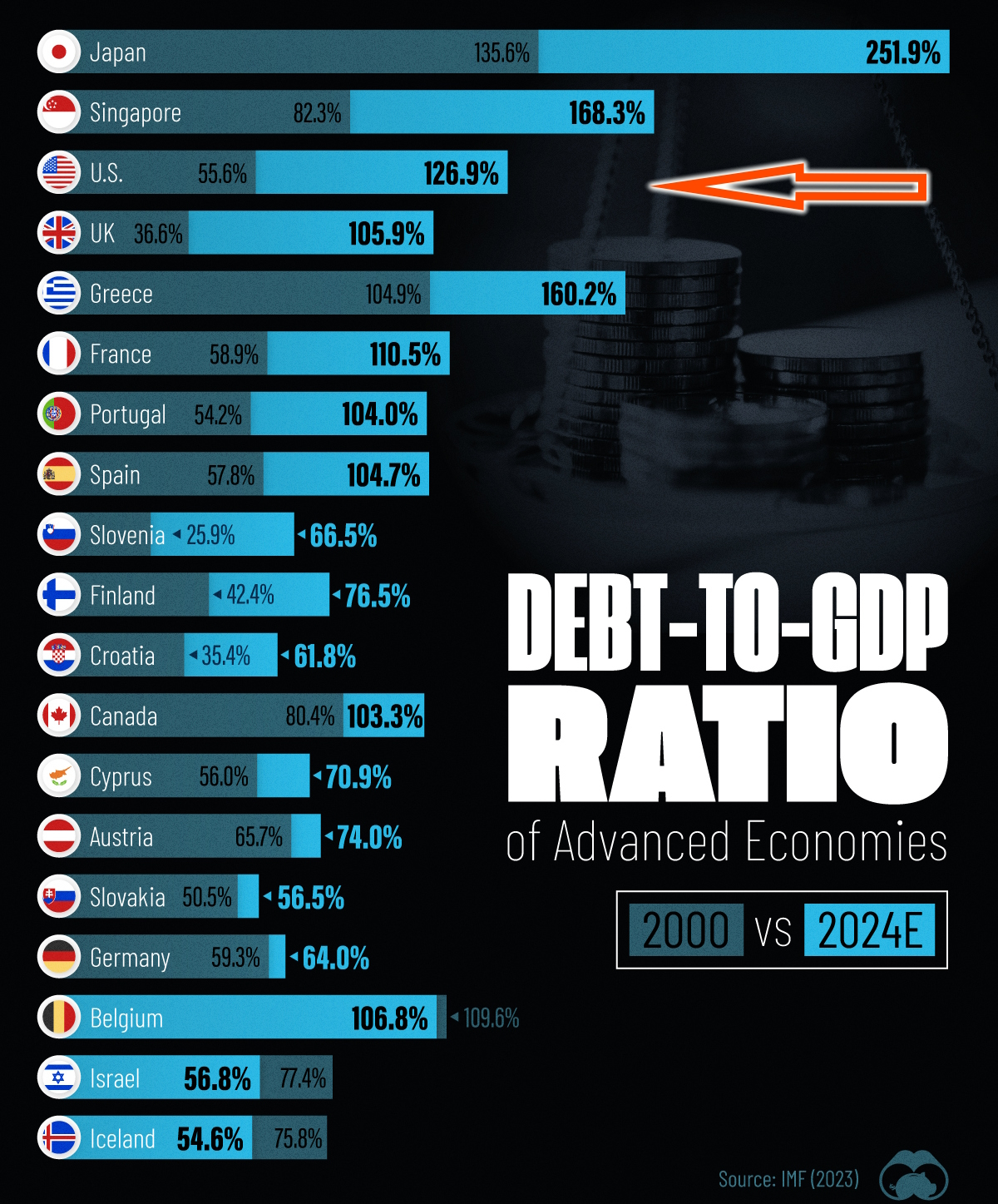

The implication being that you think the U.S. has a (relatively) small amount of debt. Now, I am willing to be convinced otherwise, but I do not think that the U.S. currently has a small amount of debt. Our debt to GDP ratio is higher than other developed nations, which is concerning.

I do concede that we aren’t in danger of a debt crisis on the scale of Greece or Sri Lanka. But ~$34 Trillion in debt needs to be part of the discussion when we keep praising the economy.